Are Fannie Mae Short Sales and Foreclosures A Bargain?

Are Fannie Mae Short Sales and Foreclosures A Bargain?

When you see a short sale or foreclosure, do you think a bargain is coming your way? My advice: slow down and see who owns the note on the property. If the foreclosure is a Fannie Mae owned property, be patient. If it is a short sale and Fannie Mae holds the lien, you should seriously question submitting an offer. You could wait months and then be asked to pay market value or higher. Don’t expect logic or common sense to found anywhere in the transaction.

Fannie Mae REO’s – Foreclosures – Not a bargain at first

Fannie Mae REO’s – Foreclosures – Not a bargain at first

Foreclosure properties have become synonomous with value if the buyer is willing to overlook certain deficiencies. There are no disclosures, the property has been vacant, neglected and possibly mistreated by the previous owner. Many buyers are willing to accept these risks if the price is right. In the current market, Fannie Mae foreclosures are initially listed over market value. The prudent buyer will recognize this and wait. Don’t assume that it is priced below market

An analysis of Fannie Mae foreclosures or REO properties that closed in January 2013 for Mesa, Gilbert, Chandler and Tempe revealed that Fannie Mae foreclosures were initally priced 20% over the eventual sales price. It appears that their strategy changed from the previous year. In January 2012, Fannie Mae properties were listed 10% over the eventual sales price.

There can only be two reasons for this direction. With low inventory, FHMA is hoping that a buyer with financing will offer the higher price and use Homepath financing which does not require an appraisal. A cash offer would have the same benefit, no appraisal. The other strategy is to steadily reduce the inflated list price until buyers find it attractive, thus convincing Fannie Mae that they received the highest possible price and compensates for increased carrying costs such as taxes, HOA dues, utilities and maintenance.

The best advice to buyers is to understand the market and don’t assume that a Fannie Mae foreclosure means bargain pricing.

Fannie Mae Short Sales – A disaster in process!

Short sales are synonomous with headache, and now Fannie Mae is trying to take it to the migrane level! I’ve had two Fannie Mae short sales that based on updated BPO’s the servicer countered at prices at or above market value. Other short sale agents have complained about the same challenge. In one instance the counter offer price from Fannie Mae was more than the price for the same floor plan for a new build, 5 years newer, in the same subdivision. The best advice is when you’re making an offer on a Fannie Mae short sale, be ready to pay market value or above, and expect no discount for being a short sale with the related uncertainty.

Short sales are synonomous with headache, and now Fannie Mae is trying to take it to the migrane level! I’ve had two Fannie Mae short sales that based on updated BPO’s the servicer countered at prices at or above market value. Other short sale agents have complained about the same challenge. In one instance the counter offer price from Fannie Mae was more than the price for the same floor plan for a new build, 5 years newer, in the same subdivision. The best advice is when you’re making an offer on a Fannie Mae short sale, be ready to pay market value or above, and expect no discount for being a short sale with the related uncertainty.

It would be very beneficial when considering a foreclosure or short sale to research which investor holds the note. If it is a foreclosure, Fannie Mae will eventually lower the price, but with a JFannie Mae short sale it may be better to move on.

Related Posts

In search of happily ever after with an Arizona Short Sale

Who really loses on a foreclosure? The Bank- Think Again

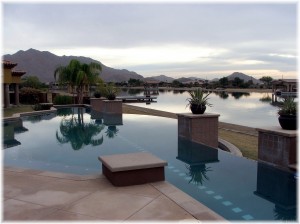

The Lakes in Tempe Waterfront Property and Homes

[rss feed=http://idx.diversesolutions.com/Feed/RSS/2073948 num= 6]