Arizona Jobs Bill – HB 2001 will lower business property taxes, targets jobs creation

Arizona is open for business with business property tax cuts and targeted incentives aimed at job creation. That’s the purpose and strategy behind HB 2001 that was signed into law last month. That’s what the sponsors want you to remember. What they didn’t tell you is what will happen to residential property taxes. Buried deep in the 214 page bill is a change to the tax treatment of residential property. And in this bill what they didn’t tell you will cost you. How so? Read on.

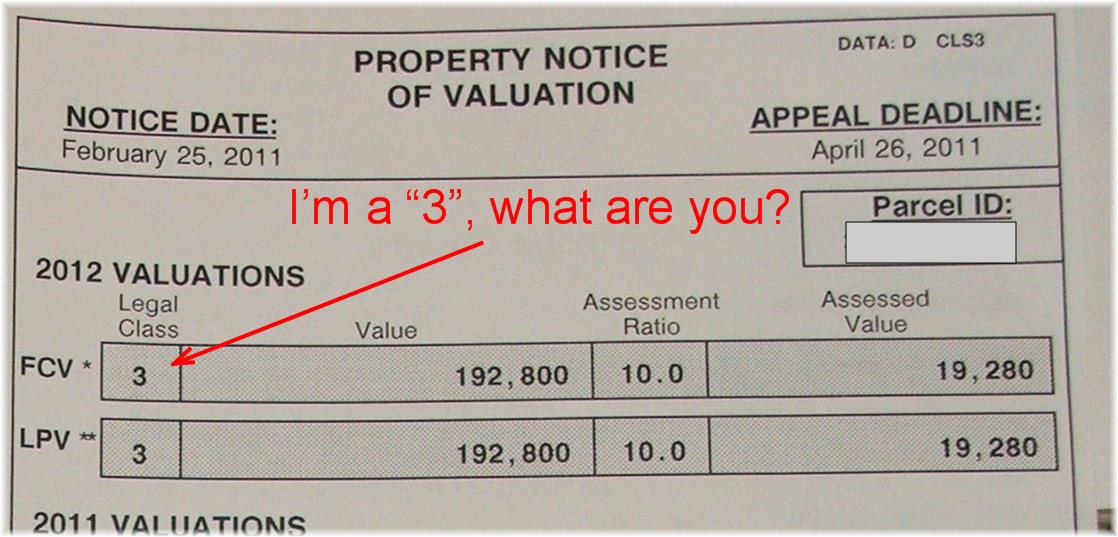

Are you a Class 3 or Class 4 Property Owner?

Class 3 properties include owner occupied primary residences and vacation/second homes. The picture above is my Property Notice of Valuation I received in February and shows the legal classification of my home. If your property falls in the class 3 category, you are currently a recipient of a rebate from the State General Fund. The State Aid Credit reduced my property tax bill by $273.74. You can see the value of this aid or credit in the detail of your tax bill. To see how to see the detail of your tax bill including any credit for State Aid Credit, click on researching your tax bill. Rental properties fall into the class 4 category which do not currently receive the State Aid Credit.

detail of your tax bill including any credit for State Aid Credit, click on researching your tax bill. Rental properties fall into the class 4 category which do not currently receive the State Aid Credit.

Under the new “Jobs Bill”, vacation and second homes will lose the rebate /credit resulting in increased property taxes. Besides automatically disqualifying second/vacation homes from the credit, owner occupant homeowners will lose their credit or rebate unless they go through the process of signing and returning an affidavit beginning in 2012 and then subsequent even-numbered years that they live in the home or if it is being leased to a relative. The affidavit must be mailed along with the annual Notice of Full Cash Value which must be returned to the County Assessor within 60 days or the residential property will be reclassified as Class Four and owners will see their taxes increase by as much as $600 for the year. Not being aware of this change and forgetting to return the signed affidavit beginning in 2012, which is bound to happen to many homeowners, will mistakenly and automatically increase property taxes for owner occupants who should receive the credit. **Make sure that next February you read in detail any propert tax valuation notices you recieve and return the affidavit promptly so you don’t lose out on the tax credit you’ve been automatically receiving so far!**

Feb. 26, 2012 Update: Homeowner’s Affidavit Update

Related Posts: