Will Your Short Sale Last?

Contract acceptance is the honeymoon… everyone anticipates a happy ending, then real life sets in. As in real life not all marriages survive, neither do all accepted short sale offers! Its like dating a beauty queen or the all-star quarterback. It’s love at first sight and WOW that list price is amazing. It may be the nicest Scottsdale, Chandler or Gilbert waterfront property you’ve seen. But with time you find out that this short sale process uncovers some severe flaws that were unforeseen. Here’s real life situations where “flaws” have surfaced and that promising short sale deal falls apart before happily ever after comes!

Short Sale Personality Flaws in Phoenix Real Estate

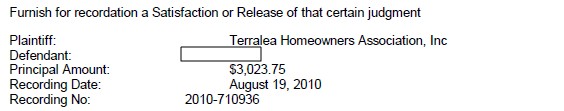

- HOA dues have not been paid and the association is not budging. One of the first questions I ask of a

homeowner considering a short sale is how far behind are they on their association dues. HOA’s know they can make or break the deal. At worst case, it may have been years since HOA dues have been paid and a judgement has been filed.

homeowner considering a short sale is how far behind are they on their association dues. HOA’s know they can make or break the deal. At worst case, it may have been years since HOA dues have been paid and a judgement has been filed. - There is more than one loan and worse yet, the second is not purchase money. One loan with a single lender improves the odds of success versus two loans with two lenders. It is extremely important to understand the types of loans associated with the property. Are they purchase money loans or is one a home equity loan.

- You believed the list price. It looked too good to be true, but you thought that the lender would accept the price since it is in fact the list price, right there in black and white. And now the buyer’s type-A personality requires that the offer is 20% below the list price because there are some cosmetic issues with the home. Buyers must understand that the short sale process will involve a BPO or appraisal to accesss the fair market value and compare it to the offer price. Buyers and their Realtor should review comparable sales to understand the fair market and formulate the offer based on that information. Don’t take the list price as what the lender will accept, unless it says it is pre-approved at that price. Buyers can offer whatever they want, but understand the process whereby the lender will evaluate any offer.

- That older home that has a lot of personality, charm and character also has a lot of issues. With older homes you need to see

evidence of on-going upkeep. The issue is that if the sellers have been battling a financial hardship, the maintenance of the house probably suffered. Evidence of these problems will come up during the inspection, after the approval has been received for which you waited 3 months! The picture to the right is a can in the attic that is strategically located below the leak in the roof to catch the water during the rain storm. Since short sales are sold in “as-is” condition, the buyer(s) have just seen the cost of the house increase if they choose to move forward.

evidence of on-going upkeep. The issue is that if the sellers have been battling a financial hardship, the maintenance of the house probably suffered. Evidence of these problems will come up during the inspection, after the approval has been received for which you waited 3 months! The picture to the right is a can in the attic that is strategically located below the leak in the roof to catch the water during the rain storm. Since short sales are sold in “as-is” condition, the buyer(s) have just seen the cost of the house increase if they choose to move forward. - The seller decides to “let the house go”. The seller feels relieved that the house is now under contract and the

approval should come shortly, so why keep the utilities on? Or keep the pool maintained? Surely, the buyer will understand that’s hardship. This may seem short sighted, but when the owners have relocated and the house is out of sight and out of mind, those utility bills become a nusance. Lines 166 – 171 state that the seller warrants and shall maintain the premises so that they will be in substantially the same condition as on the date of Contract acceptance. For an escrow process that extends month upon month, this can be a challenge.

approval should come shortly, so why keep the utilities on? Or keep the pool maintained? Surely, the buyer will understand that’s hardship. This may seem short sighted, but when the owners have relocated and the house is out of sight and out of mind, those utility bills become a nusance. Lines 166 – 171 state that the seller warrants and shall maintain the premises so that they will be in substantially the same condition as on the date of Contract acceptance. For an escrow process that extends month upon month, this can be a challenge. - The servicer, investor, or mortgage insurance company requires a seller contribution from the seller that they cannot or are unwilling to pay. This is extremely frustrating since you’re almost at the finish line and you’ve waited months to find out they’re asking the seller to contribute and the seller may throw in the towel. The buyer may even be asked to contribute to make up some of the difference. Arizona revised statutes protect a homeowner against deficiency judgements in the event of foreclosure, so why should the seller pay the lender, servicer or mortgage insurance company when it is more cost effective to walk away? The painful part is that this drama will unfold at the end of the negotiation process with the lienholders.

- The seller does not disclose that there may be additional liens or judgements on the property. Make sure the title commitment report is reviewed as soon as possible. The listing agent should have the escrow/title company produce this shortly after the listing is taken and not wait for an offer, or worse yet the short sale approval.

Does all of this mean that you should never look at or consider a short sale? No, but make sure you understand possible problems and are prepared for these “flaws” in the process. There are actions that can be taken to reduce the risk in a short sale transaction, but some will be outside both the buyer’s and seller’s control.

All of these issues must be addressed and thought through by a seller as they consider a short sale. If you are considering a short sale and would like more information, schedule a free consultation or call me directly.