Phoenix real estate market update for 2011

Phoenix real estate market update for 2011

I found the following quote by Franklin D. Roosevelt, “There are as many opinions as there are experts.” Speculating on real estate trends is a favorite past time for anyone, especially as of late. It is easy to get caught up in the broad “one size fits all” real estate commentaries, so read on to see what’s really happening with Phoenix area real estate. To truly understand, it is always best to look at the data and identify trends.

Let first start with demand

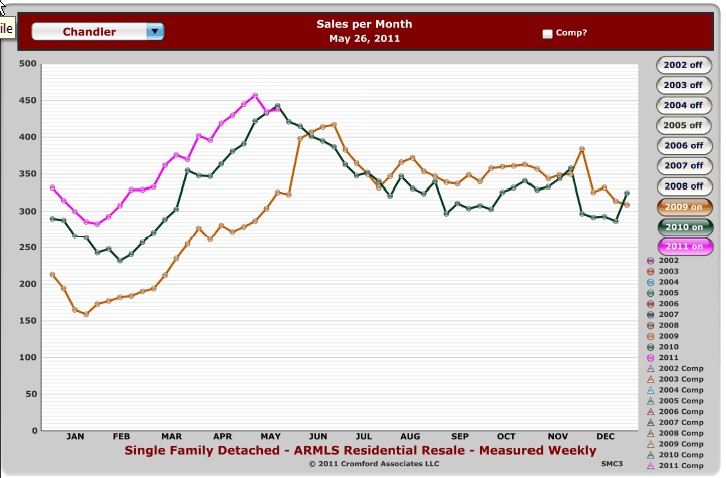

The above chart shows the single family sales per month for Gilbert for almost 2.5 years. The pink line is for 2011. Other cities and towns around the valley show a similar pattern. Chandler sales are shown on the right for more than over 2 years. In most cities, you have to go back to 2005 to find higher number of YTD sales. Obviously, the significant drop in prices have spurred demand for lower cost and affordable housing, both from investors and owner occupants.

What’s happening to inventory

Within the last month, I’ve had clients comment that there aren’t as many listings showing up, especially if they’re looking for a niche property such as Phoenix waterfront property. To the left is a graph for the Queen Creek area, which was hit particularly hard with foreclosures since many of the homes were built during the boom. All three types of listings have decreased over the last year. Understandably, buyers had come to expect a continual supply of rock bottom priced foreclosures, but the trend appears to suggest reduced supply for traditional sales, short sales and foreclosures, not just in Queen Creek but across the Phoenix valley.

Within the last month, I’ve had clients comment that there aren’t as many listings showing up, especially if they’re looking for a niche property such as Phoenix waterfront property. To the left is a graph for the Queen Creek area, which was hit particularly hard with foreclosures since many of the homes were built during the boom. All three types of listings have decreased over the last year. Understandably, buyers had come to expect a continual supply of rock bottom priced foreclosures, but the trend appears to suggest reduced supply for traditional sales, short sales and foreclosures, not just in Queen Creek but across the Phoenix valley.

There are many reasons why the foreclosures have begun to decrease and should continue. Mortgage delinquency rates are down, bankruptcies have peaked and there is a sustained downward trend in the number of notices of trustee sales  per day for Maricopa county. Notices of trustee sales are issued when a homeowner becomes sufficiently delinquent that the lender notifies the owner that the house will be sold in 90 days at trustee auction, and the property is now in pre-foreclosure status. The number of notices of trustee sales peaked in April 2009 and has shown a sustained and welcome downward trend. With fewer properties going into pre-foreclosure, fewer will become lender owned foreclosures, reducing downward pressure on prices. It is also worth mentioning that there is a distinct difference between the foreclosure process in “judicial” vs. “non-judicial” states. In states like Illinois with a judicial foreclosure, the process is much longer, even years, delaying the process for homes to return to the market. Arizona, a non-judicial foreclosure state is based on deeds of trust with a power of sale clause which enables the trustee to initiate the foreclosure process without having to go to court.

per day for Maricopa county. Notices of trustee sales are issued when a homeowner becomes sufficiently delinquent that the lender notifies the owner that the house will be sold in 90 days at trustee auction, and the property is now in pre-foreclosure status. The number of notices of trustee sales peaked in April 2009 and has shown a sustained and welcome downward trend. With fewer properties going into pre-foreclosure, fewer will become lender owned foreclosures, reducing downward pressure on prices. It is also worth mentioning that there is a distinct difference between the foreclosure process in “judicial” vs. “non-judicial” states. In states like Illinois with a judicial foreclosure, the process is much longer, even years, delaying the process for homes to return to the market. Arizona, a non-judicial foreclosure state is based on deeds of trust with a power of sale clause which enables the trustee to initiate the foreclosure process without having to go to court.

Days of Supply of Inventory

A good way to compare demand to supply is to look at the available days of inventory. In other words, based on the current sales, the inventory will be gone in “X” days unless more inventory is added. Above is a chart showing the days inventory supply for Tempe. Other days of supply graph show similar trends.

A good way to compare demand to supply is to look at the available days of inventory. In other words, based on the current sales, the inventory will be gone in “X” days unless more inventory is added. Above is a chart showing the days inventory supply for Tempe. Other days of supply graph show similar trends.

The data shows positive trends for many aspects of Phoenix valley real estate. Regardless of what many distant and removed commentators say about our real estate, we know real estate is local which is why is it important to focus on the leading indicators for those that affect Phoenix and the surrounding cities. We should see price stabilization this year and some cities will even begin to see price appreciation.

To receive the current valuation of your home, click on home valuation. Or to receive listings feel free to describe the home you’re looking for and receive updated real estate listings. Or call or e-mail at your convenience.

Related Posts:

Who Really Loses on a Foreclosure

Lender Owned Waterfront Properties

[rss feed=http://idx.diversesolutions.com/Feed/RSS/9772520 num=10]

Gilbert and Chandler Short Sale Information