Waiving The Appraisal to Compete with Cash Offers

Waiving The Appraisal to Compete with Cash Offers

In this seller favored market, buyers requiring a loan are looking for ways to compete with cash offers which have two distinct advantages. One is there is no unfulfilled loan contingency and the second is there is nno appraisal contingency. In an attempt to remove concerns over the appraisal coming in under the purchase price, buyers are using an appraisal contingency waiver. This means the buyer will make up any shortfall between the purchase price and the appraisal value which has some significant risks. To learn more, keep reading.

Waiving the appraisal contingency – partially or entirely

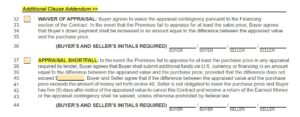

If a buyer wishes to make their offer more appealing, the additional clause addendum provides a way to waive the appraisal contingency.  The risk with this approach is that the potential difference or shortfall is unknown because the appraisal value is uncertain when the contingency is waived. Every Realtor has experienced a situation where the appraisal was a surprise that seemingly defied logic, either in a good way or negative way.

The risk with this approach is that the potential difference or shortfall is unknown because the appraisal value is uncertain when the contingency is waived. Every Realtor has experienced a situation where the appraisal was a surprise that seemingly defied logic, either in a good way or negative way.

To minimize this risk, another strategy would be to limit the shortfall amount that will be contributed in case the appraisal comes in less than the purchase price. The buyer can specify an amount that will be contributed in this situation. Again, we go to the additional clause addendum and Appraisal Shortfall.  This option affords the buyer an opportunity to review the available funds and make an informed decision instead of agreeing to an amount that is unknown until the appraisal is received. Talk about stressful!! Buyers should also be prepared to show proof of funds demonstrating that the buyer can make up an appraisal shortfall.

This option affords the buyer an opportunity to review the available funds and make an informed decision instead of agreeing to an amount that is unknown until the appraisal is received. Talk about stressful!! Buyers should also be prepared to show proof of funds demonstrating that the buyer can make up an appraisal shortfall.

If you need assistance navigating this market and would like to receive homes for sale as soon as they are available, please click on Receive Homes As They Come On The Market.

Or call/text me at 480-326-8571 for more immediate assistance.

Related Posts