What is a Community Facility District?

A community facility district is often referred to as a CFD. You may not always be aware that a house is located in a CFD. So what are the drawbacks or advantages and how do you determine if a house is in a subdivision with a community facility district? Are there any tell tale signs that can help you know?

Determining if a house is in a special tax district or CFD

Community Facility Districts (CFD) are financed through the creation of a special tax district. They are financed through general obligation and special assessment bonds that are paid by the homeowner. One trademark is their size; typically very large communities with upgraded amenities such as community parks, pools, and even golf courses. You may recognize the more familiar ones such as Eastmark, Marley Park, Trilogy at Vistancia, Anthem at Merrill Ranch, DC Ranch in Scottsdale, Canta Mia, Verrado, and Estrella Mountain Ranch.

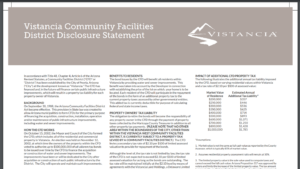

If you are considering a new construction home, one of the questions that you o r your realtor should ask is if the subdivision is part of a CFD. If it is then they should provide a CFD disclosure that goes into more detail about the bonds and the anticipated taxes that accompany the special tax district or CFD. If you compare taxes between homes in a CFD and those that are not, you’ll notice a difference in taxes.

r your realtor should ask is if the subdivision is part of a CFD. If it is then they should provide a CFD disclosure that goes into more detail about the bonds and the anticipated taxes that accompany the special tax district or CFD. If you compare taxes between homes in a CFD and those that are not, you’ll notice a difference in taxes.

So how do you determine if a resale home is in a CFD? The only way is to the county treasurer website. You’ll have to enter the parcel number and drill down to the tax details for that specific property. Look for the special tax district section and review the line items looking for a tax associated with the CFD.

county treasurer website. You’ll have to enter the parcel number and drill down to the tax details for that specific property. Look for the special tax district section and review the line items looking for a tax associated with the CFD.

If you would like assistance in looking for a house and want daily property updates, click on send me updated property information.

Related Posts