What is Home Equity Theft?

What is Home Equity Theft?

Home Equity Theft is a phrase that is used when governments and investors use tax liens and tax deeds to legally take a homeowner’s property and their equity. This has been become common practive in many states. It is finally getting the attention it deserves now that the case Tyler vs. Hennepin County is in front of the U.S. Supreme Court.

Unpaid property taxes and just compensation

There is an industry that is encouraged by investors and state governments whereby homeowners with unpaid property taxes are at risk of losing their property and all of the equity that they’ve built up. The mechanism that allows this is the fact that property tax liens and deeds can wipe out mortgages and other liens giving the recipient of the tax lien or deed an unencumbered property.

Geraldine Tyler vs. Hennepin County

The cas.e that is currently in front of the U.S. Supreme Court is ab out Geraldine Tyler, a 90+ year old widowe. She purchased a condo and then after some events in the neighborhood, she and her famiily decided it was best for her to move to an aparment for senior citizens. Subsequently, she fell behind in property taxes by $2,300. This amount climbed to $15,000 when the county sold the property for $40,000. What happened to the $25,000 difference between the amount owed and the sales price? The government kept it!! You can see why a reasonable person would claim this practice should be elevated to the US Supreme Court since it sure appears to be home equity theft.

out Geraldine Tyler, a 90+ year old widowe. She purchased a condo and then after some events in the neighborhood, she and her famiily decided it was best for her to move to an aparment for senior citizens. Subsequently, she fell behind in property taxes by $2,300. This amount climbed to $15,000 when the county sold the property for $40,000. What happened to the $25,000 difference between the amount owed and the sales price? The government kept it!! You can see why a reasonable person would claim this practice should be elevated to the US Supreme Court since it sure appears to be home equity theft.

Home Equity Theft via Arizona Tax Liens

Arizona auctions tax liens once a year. Investors bid on the interest rate and pay the back taxes. The homeowner has 3 years to pay the unpaid taxes plus 16%. If they fail to redeem the tax certificate the investor who puchased the line can do a judicial foreclosure on the property and receive the title and wipe out most of the liens. The homeowner loses all the equity in the property and the title.

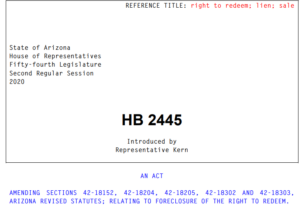

In 2020, AZ HB 2445 was introduced by Anthony Kern that would have eliminated this unjust taking. It would have changed the process to be more like a mortgage foreclosure where the property is auctioned to the highest bidders and the homeowner receives a portion of the equity. It was introduced in February of 2020, but died within 6 months, never getting the support to advance. It would have been a step in the right direction.

In 2020, AZ HB 2445 was introduced by Anthony Kern that would have eliminated this unjust taking. It would have changed the process to be more like a mortgage foreclosure where the property is auctioned to the highest bidders and the homeowner receives a portion of the equity. It was introduced in February of 2020, but died within 6 months, never getting the support to advance. It would have been a step in the right direction.

The Supreme Court will hear arguments in April 2023 and make a decision in June.

IF you’d like to be notified of homes automatically, click on receive properties as they come on the market.

Related Posts