Critical questions for the lender

Critical questions for the lender

Once you’ve uploaded and sent all the documents that your lender has asked for, it’s your turn to ask the questions. How do you know the lender or loan officer has chosen the best loan program for you? Have they shared the closing costs that you’ll need in addition to the down payment? You need to make sure the lender explains some key issues when it comes to getting prequalified. Continue reading to learn more about the important topics you need to be discussing with your lender.

What your lender should be telling you

Your lender has a wealth of information they can share. Take advantage of this and make sure you are asking the rignt questions. One of the first ones should be “Why did your chose the loan program that you are recommending?” Have them explain why this was more advantageus than another. The next question should be is, “what are my closing costs?” Don’t settle for a broad range. It will take more work but you need to have an informed estimate since since this will affect the amount of money you need to bring to the table.

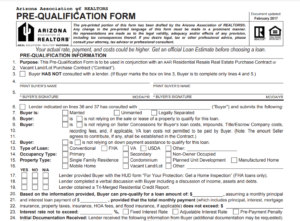

A personal favorite is will the lender be willing to use the AAR Prequalification Form instead of their generic templated form. Using this form will help the buyer since it provides the seller and listing agent a more thorough representation of the buyer’s ability to purchase a property.

Probably the most important question that you can ask the lender will be “what will my monthly payment be?” Understand that the lender will not know the exact amount until you have a property in escrow.

If you’d like to be notified of homes automatically as they come on the market, click on receive properties as they come on the market. Or feel free to reach out to me directly or text at 480-326-8571.

Related Posts

Prequalification and your credit score