Let’s sit back and take a look at what happened in 2023 in the Phoenix real estate market. There was a lot going on! Prices bottomed out at the beginning of 2023. Speculation on what the Federal Reserve was going to do was a daily discussion. Pundits were obliged to opine on what this would do to inflation and interest rates. Like I said, what a year!! And the big question, what did all of this do to prices and home sales. Buck up because that’s exactly what we’re going to discuss.

Let’s talk mortgage interest rates

2021 was the gold standard year for interest rates. Buyers and home owners that refinanced were spoiled and many were able to secure rates below 3%. These interest rates increased buyers’ purchasing power even while prices increased. Then inflation showed it was not transitory and the Fed was compelled to address the problem. That’s why we saw 7 rate increases during 2022 to the Fed funds rate and 4 more in 2023. In the mean time everyone was watching GDP, inflation reports, employment numbers, and economic trends to see what mortgage rates would do.

2021 was the gold standard year for interest rates. Buyers and home owners that refinanced were spoiled and many were able to secure rates below 3%. These interest rates increased buyers’ purchasing power even while prices increased. Then inflation showed it was not transitory and the Fed was compelled to address the problem. That’s why we saw 7 rate increases during 2022 to the Fed funds rate and 4 more in 2023. In the mean time everyone was watching GDP, inflation reports, employment numbers, and economic trends to see what mortgage rates would do.

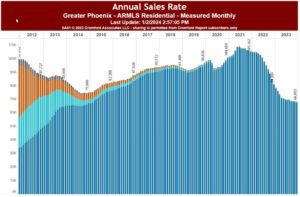

The effect of high interest rates impacted sales to the point where 4th quarter 2023 homes sold bottomed out to a level not seen since 2008. Obviously, a drop in interest rates will lead to better buyer affordability. And the good news is that interest rates peaked in October 2023 and are on a downward trend.

The effect of high interest rates impacted sales to the point where 4th quarter 2023 homes sold bottomed out to a level not seen since 2008. Obviously, a drop in interest rates will lead to better buyer affordability. And the good news is that interest rates peaked in October 2023 and are on a downward trend.

Looking forward to 2024

If you would like to be kept up to date with the most recent properties for sale, click on Send Me Listings Automatically to have them delivered to your email automatically. New listings will be sent to you within hours of going on the market. For more information, please reach out to me via email or by phone 480-326-8571.

If you would like to be kept up to date with the most recent properties for sale, click on Send Me Listings Automatically to have them delivered to your email automatically. New listings will be sent to you within hours of going on the market. For more information, please reach out to me via email or by phone 480-326-8571.