Headlines quick to report foreclosure activity rises in 21 states

News of this activity seemed to cast doubt on a housing recovery, and gives hope to buyers who have been watching the market for great deals that have seemed to evaporate in the last 12 months. One article even said it was the 2012 tidal wave of foreclosures. The trap that many fall into is not understanding the underlying cause as why this is happening in these specific states. Some states have been impacted harder than others; Florida, California, Arizona, Georgia, and Nevada, to name a few. However, the increase in foreclosure activity in this case can be better traced to the foreclosure process employed by a state. The above graph shows the pending foreclosures for Maricopa county. No tsunami or tidal wave on the horizon for Arizona. Read on to find out why.

News of this activity seemed to cast doubt on a housing recovery, and gives hope to buyers who have been watching the market for great deals that have seemed to evaporate in the last 12 months. One article even said it was the 2012 tidal wave of foreclosures. The trap that many fall into is not understanding the underlying cause as why this is happening in these specific states. Some states have been impacted harder than others; Florida, California, Arizona, Georgia, and Nevada, to name a few. However, the increase in foreclosure activity in this case can be better traced to the foreclosure process employed by a state. The above graph shows the pending foreclosures for Maricopa county. No tsunami or tidal wave on the horizon for Arizona. Read on to find out why.

Judicial or Non-Judicial Foreclosure- What is Arizona?

26 states employ a judicial foreclosure which is processed through the courts where the lender files a complaint and records a notice of Lis Pendens. This is more prevalent in the east and mid-west in states such as Florida, Illinois, Wisconsin, Delaware, and Pennsylvania. The homeowner may appear before the judge and dispute any material facts.

The remaining states use a non-judicial foreclosure process. Arizona is such a state. This gives the lenders the ability to sell the property without court involvement. The process is much simpler and quicker. After missed payments the lender will issue a Notice of Trustee Sale, typically 90 days after the first missed payment. The Notice of Trustee Sale will set a sale date usually 90 days from the notice date.

What was really said about the “tidal wave of foreclosures”?

Brandon Moore of Realty Trac also said, “The foreclosure and mortgage settlement filed in court earlier this week will help pave the way to a properly functioning foreclosure process by providing a clear roadmap for necessary foreclosures,” Moore continued. “That should result in more states posting annual increases in the coming months. Not surprisingly, many of the biggest annual increases in February were in states with the more bureaucratic judicial

foreclosure process, which resulted in a larger backlog of foreclosures built up over the last 18 months in those states.”

Activity in the 26 states with a judicial foreclosure process rose 24% in February, compared with February 2011, while activity in 24 states with a non-judicial process decreased 23%. Bottom line: The non-judicial states are processing the foreclosures quicker compared to their judicial counterparts. As the housing market bottoms out in many states, the blanket one size fits all comments about real estate can be very misleading. Just ask any buyer trying to purchase a house in the east valley who has submitted an offer only to find out that it went for above list price and there were 5 competing buyers.

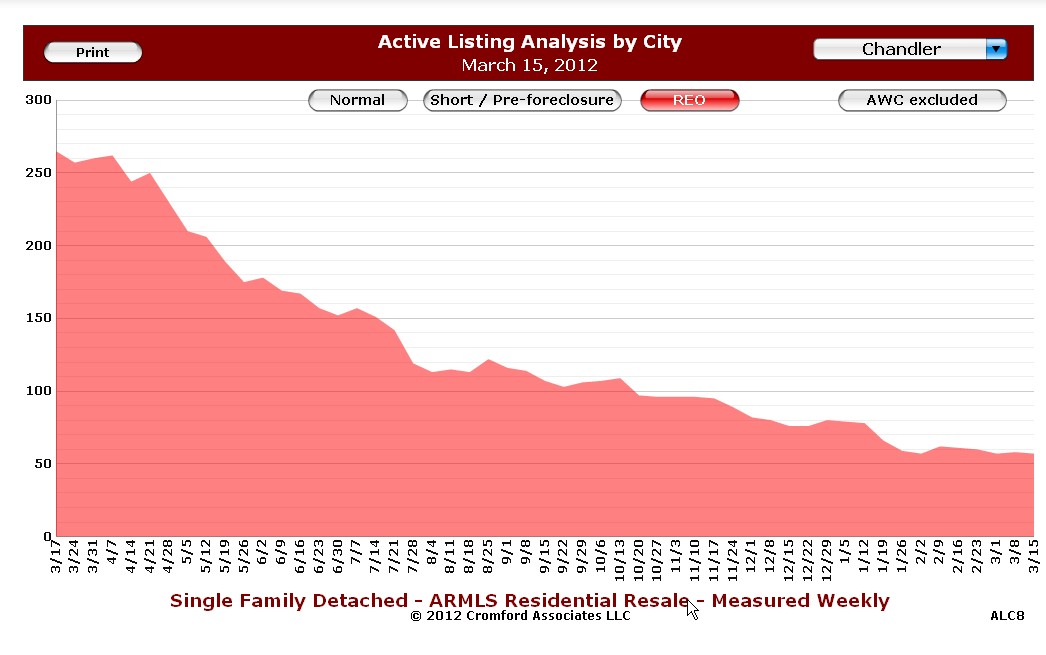

Lender-owned foreclosures in Gilbert and Chandler

The graph to the left shows the active listings for Chandler foreclosures. It is clearly evident that the number of foreclosures is in significant decline as fewer homeowners are receiving a notice of trustee sale. Even if it levels out, I don’t see evidence of a tidal wave of foreclosures.

The graph to the left shows the active listings for Chandler foreclosures. It is clearly evident that the number of foreclosures is in significant decline as fewer homeowners are receiving a notice of trustee sale. Even if it levels out, I don’t see evidence of a tidal wave of foreclosures.

If you are interested in receiving lender-owned foreclosures in any Phoenix area city, click on receive up to date foreclosure properties.

Related Posts:

Where’s the real estate market going in 2012?

Who really loses on a foreclosure?

Bank-owned Waterfront Foreclosures

[rss feed=http://idx.diversesolutions.com/Feed/RSS/12446933 num= 7]