Interest Rates impact Buyers

As we attempt to cover the Phoenix real estate market, It is very evident that higher interest rates have an effect on buyer sentiment and demand. Every 1% rise in interest rates increases the loan payment portion by 10%.

Buyer demand has been supressed with most cities seeing a 10% – 30% reduction due to higher rates. To understand buyer demand, inventory levels and more, click on the video below:

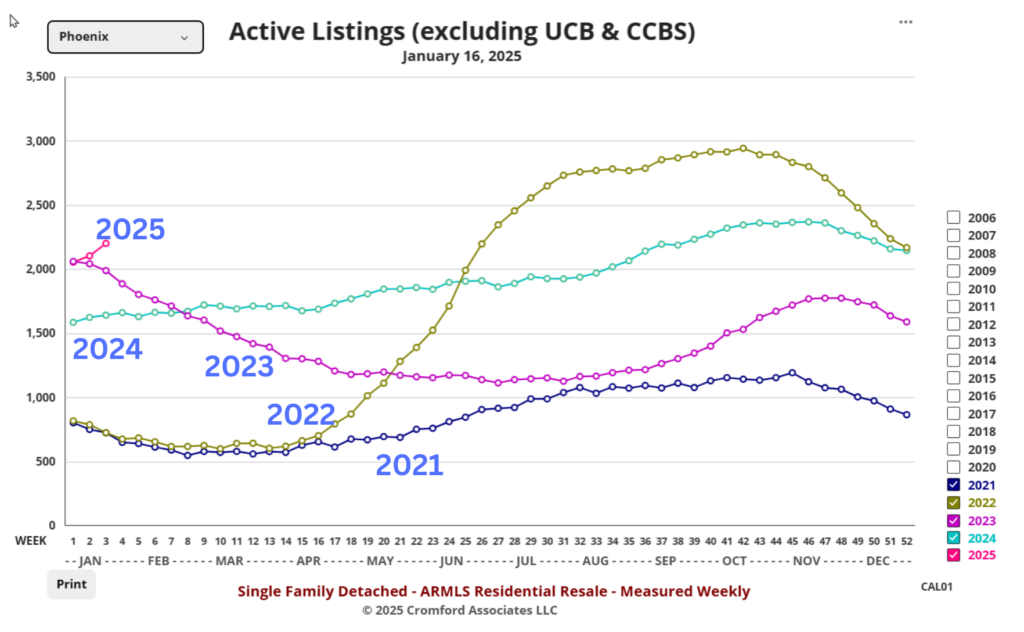

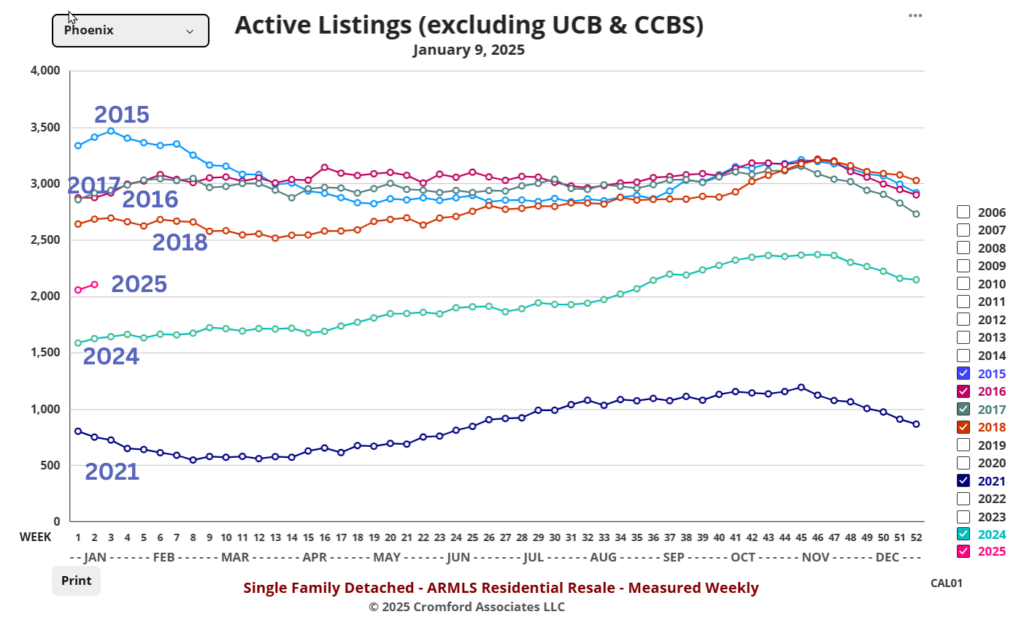

Inventory Surge? - Not quite

Many real estate pundits will have you believe that inventory is surging which will result in an upcoming fall in prices. Well, when you come current levels to the rock bottom inventory levels of 2021, they have a point.

Inventory levels more than doubled in many cities. However, when compared to pre-pandemic inventory levels we are below normal as we enter into 2025. One reason is what is called the Lock In effect that is a disincentive to sell, reducing inventory levels. So bottom line, homes for sale are not surging!

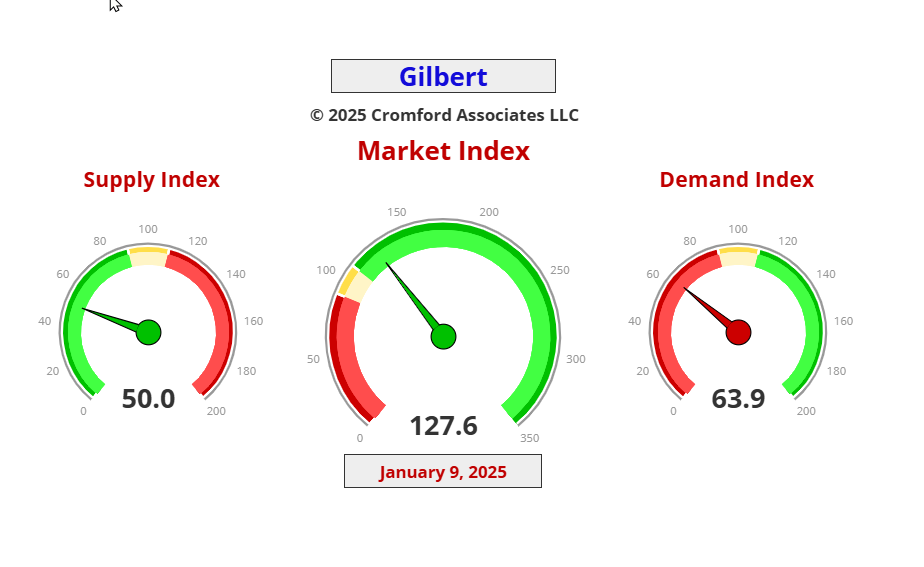

Are we in a buyer or seller's market?

When we overlay supply on buyer demand we get a better understanding of buyer and seller markets. To do this we turn to the Cromford Market index that rates each city ranging from a buyer’s market, balanced market or seller’s market.

The analysis of each city under this lense reveals something interesting in the Phoenix real estate market. You cannot cast a blanket conclusion over the Phoenix valley. Each city differs on this buyer-seller scale. Some fall squarely in the buyer’s market market such as Maricopa, Buckeye or Casa Grande. Other lean more towards the seller’s market territory such as Chandler and Tempe.

If you’d like to be kept up to date with the most recent listings for your customized search, click on Send Me Listings Automatically. You’ll receive homes that fit your criteria and then be updated within hours of homes coming on the market.

National debt and the housing market

The national debt plays an important part in the housing market. This article “Why the National Debt Matters in Housing“. It puts forth a well documented presentation of how the national debt will adversely impact mortgage rates over the long term The interest payment on the national debt continue to increase year over year inviting deficit spending if the country does not live within it’s means.

If you still have questions about the Phoenix real estate market review that I did not answer in the video or this blog, reach out to me at 480-326-8571, or email me at gordon@myhomeinaz.com. I look forward to assisting you.